How to Get an Instant Loan without Documents Online

Are you in urgent need of funds but tired of the lengthy documentation process? Look no further! With the advent of instant loan without documents online, your financial worries can be alleviated in no time. These hassle-free loans offer a convenient solution, allowing you to obtain the funds you require without the burden of extensive paperwork. Simply complete a quick online application, and within a few clicks, you can be on your way to accessing the money you need. Embracing the power of technology, instant loans without documents online provide a seamless and efficient borrowing experience, ensuring that you can swiftly address your financial emergencies. Say goodbye to the tedious paperwork and say hello to a convenient and hassle-free borrowing option today!

Table of Contents

Growing Popularity:

Are you in need of quick and convenient access to funds? Look no further than the growing popularity of Instant loan in India. With the rise of smartphones and widespread internet connectivity, applying for loans has never been easier. instant loan without documents online offers unparalleled convenience, allowing borrowers to apply for loans anytime and anywhere, without the hassle of paperwork and lengthy approval processes.

The streamlined application process and fast fund disbursement make Instant loan a game-changer. Whether you’re an entrepreneur looking to expand your business or an individual in need of immediate financial assistance, Instant loan provides a seamless experience. Embracing technology and user-friendly interfaces, Instant loan platforms are revolutionizing the financial landscape, making loans accessible to all.

Say goodbye to traditional banking hassles and embrace the growing popularity of Instant loan for quick, hassle-free, and reliable financial solutions.

Convenience and Accessibility:

In today’s fast-paced world, convenience and accessibility are paramount when it comes to financial services, and that’s where Instant loan shines. With the widespread adoption of smartphones and internet connectivity, accessing loans has never been easier. Instant loan platforms offer unparalleled convenience, allowing borrowers to apply for loans from the comfort of their homes or on the go.

Say goodbye to long queues and paperwork at traditional banks. With just a few clicks, borrowers can complete the application process, submit necessary documents, and track their loan status online. The streamlined and user-friendly interfaces of digital lending platforms ensure a hassle-free experience. Whether you need funds for a personal emergency or a business venture, digital lending provides instant access to funds with quick approval and disbursement. Embrace the convenience and accessibility of digital lending to meet your financial needs swiftly and efficiently.

Streamlined Application Process:

When it comes to borrowing money, time is of the essence, and that’s where the streamlined application process of Instant loan truly shines. Say goodbye to the days of tedious paperwork and lengthy approval times. Digital lending platforms have revolutionized the borrowing experience with their user-friendly interfaces and simplified processes.

Applying for a loan has never been easier – borrowers can complete the entire application process online, from the comfort of their homes or on the go using their smartphones. With just a few clicks, borrowers can input their information, upload necessary documents, and submit their applications within minutes. The use of advanced technology and data analytics enables quick and accurate evaluation of creditworthiness, expediting the loan approval process.

So, whether you need funds for a medical emergency or a business opportunity, digital lending’s streamlined application process ensures that you get the financial assistance you need without unnecessary delays. Embrace the convenience and efficiency of Instant loan’s streamlined application process to access funds swiftly and meet your financial goals.

Quick Disbursement:

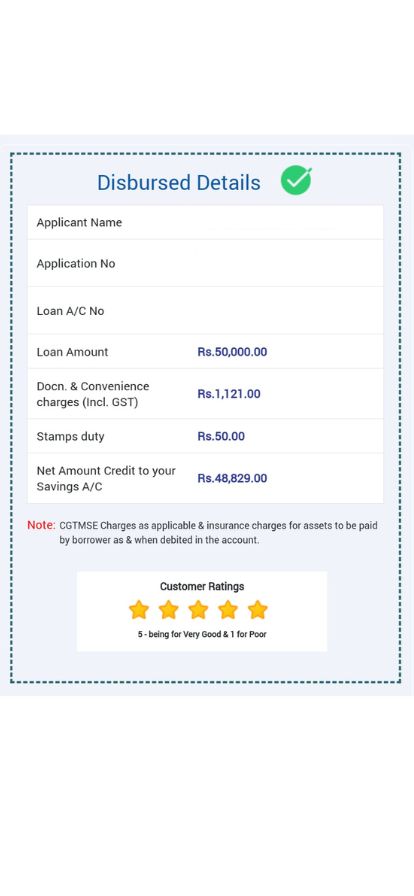

When you’re in need of funds urgently, the quick disbursement offered by digital lending can be a game-changer. Unlike traditional lending institutions that may take days or even weeks to process and approve a loan, instant loan without documents online platforms excel in their ability to provide fast access to funds.

With just a few simple steps, borrowers can complete the application process online and receive loan approval within hours. Once approved, funds are swiftly transferred directly to the borrower’s bank account, enabling them to address their financial needs promptly. This quick disbursement is made possible through the use of advanced algorithms and digital processes, eliminating the need for time-consuming manual reviews.

Whether it’s a medical emergency, home repair, or unexpected expenses, digital lending’s quick disbursement ensures that you have the funds you need when you need them most. Embrace the speed and efficiency of instant loan without documents online for quick disbursement and gain peace of mind knowing that financial assistance is just a few clicks away.

Financial Inclusion:

In the realm of digital lending, financial inclusion takes center stage, transforming the landscape of access to credit. Instant loan platforms have become powerful tools in bridging the gap between individuals and financial services, particularly for those traditionally underserved by traditional banking institutions.

By leveraging technology and innovative approaches, digital lending promotes financial inclusion by extending credit to individuals who may have limited credit history or lack collateral. This inclusive approach empowers people from all walks of life, including those in remote areas, to fulfill their financial needs.

With simplified processes, quick approvals, and flexible loan options, instant loan without documents online open doors for individuals to realize their dreams, whether it’s starting a small business or pursuing higher education. Embrace the era of financial inclusion through digital lending, where everyone has a chance to access the credit they deserve and embark on a path toward financial prosperity.

Customized Loan Products:

When it comes to borrowing money, one size does not fit all, and that’s where customized loan products in Instant loan come into play. Digital lending platforms have revolutionized the lending landscape by offering personalized loan options tailored to individual needs.

Through advanced algorithms and data analytics, digital lenders assess borrower profiles to determine their unique requirements and repayment capabilities. This enables borrowers to access loan products that align with their financial goals and constraints.

Whether it’s a short-term loan for a home renovation or a long-term loan for business expansion, Instant loan provides a range of customizable loan products. Say goodbye to rigid loan terms and embrace the flexibility of customized loan products through digital lending, where you can find the perfect fit for your financial needs.

Transparent and Competitive Interest Rates:

Transparency and competitive interest rates are at the core of Instant loan, reshaping the borrowing experience for individuals and businesses alike. Unlike traditional lending institutions that often leave borrowers guessing about their interest rates, digital lending platforms offer transparency right from the start.

Borrowers can easily access and compare interest rates online, empowering them to make informed decisions. Moreover, the competitive nature of Instant loan drives lenders to offer attractive interest rates to stay ahead in the market.

This creates a favorable environment for borrowers, providing them with the opportunity to secure loans at competitive rates that suit their financial capabilities. Say goodbye to hidden fees and uncertain interest rates, and embrace the transparency and competitiveness of digital lending for a seamless borrowing experience.

Enhanced Credit Assessment:

Digital lending has revolutionized the credit assessment process, offering enhanced accuracy and efficiency. Leveraging advanced technology and data analytics, Instant loan platforms can assess creditworthiness with greater precision.

Traditional credit scoring models often rely solely on credit history, leaving many individuals without substantial credit records unable to access loans. However, digital lending platforms consider alternative data sources, such as digital footprints and transaction history, to evaluate creditworthiness comprehensively.

This inclusive approach enables a more accurate assessment, allowing borrowers with limited credit histories to access the funds they need. With enhanced credit assessment in Instant loan, borrowers can enjoy a fair and personalized evaluation process that opens doors to financial opportunities through instant loan without documents online.

Digital Security Measures:

Instant loan platforms prioritize the security of borrowers’ personal and financial information through robust digital security measures. With the increasing reliance on digital platforms, ensuring data privacy and protection has become crucial.

Digital lending platforms employ advanced encryption technology, secure data transmission protocols, and multi-factor authentication to safeguard sensitive information. Additionally, they comply with regulatory requirements and industry standards to maintain the highest levels of data security.

These measures provide borrowers with peace of mind, knowing that their information is protected from unauthorized access or breaches. When opting for instant loan without documents online, you can trust that your data is in safe hands, allowing you to focus on your financial goals without worrying about compromising your security.

Impact on Traditional Banking:

The rise of Instant loan has had a profound impact on traditional banking institutions. As digital lending platforms gain popularity, they pose a challenge to traditional banks by offering convenient and accessible loan options to borrowers. With streamlined processes, quick approvals, and competitive interest rates, Instant loan platforms provide a compelling alternative to traditional banks.

To stay competitive, many traditional banks are now embracing digital transformation and partnering with digital lending platforms to offer their own online loan products. This shift in the banking landscape benefits consumers as it promotes innovation and competition, ultimately leading to more customer-centric services and improved overall banking experience.

As Instant loan continues to disrupt the industry, traditional banks are adapting to keep up with the changing demands and expectations of borrowers.

Reduced Documentation and Paperwork:

Digital lending has ushered in a new era of convenience and efficiency by significantly reducing the burden of documentation and paperwork. Unlike traditional lending processes that involve lengthy paperwork and numerous physical documents, Instant loan platforms streamline the application process, making it hassle-free for borrowers.

With just a few simple steps, borrowers can complete the entire application online, eliminating the need for physical paperwork. Digital lending platforms utilize advanced technology and secure data transmission to securely collect and verify necessary documents electronically. This not only saves borrowers valuable time but also reduces the chances of document loss or misplacement.

Embrace the ease and simplicity of Instant loan, where reduced documentation and paperwork ensure a seamless borrowing experience, allowing you to focus on what truly matters – achieving your financial goals.

Credit Score Building:

Digital lending has emerged as a powerful tool for credit score building. For individuals with a limited credit history or a less-than-ideal credit score, Digital Financing platforms offer an opportunity to improve their creditworthiness. By responsibly borrowing and repaying loans on time, borrowers can demonstrate their creditworthiness and build a positive credit history.

Digital lenders often report loan repayment data to credit bureaus, ensuring that borrowers’ efforts are recognized and reflected in their credit scores. This presents a valuable opportunity for individuals to rebuild or establish credit, opening doors to better loan terms and financial opportunities in the future. With Digital Financing’s focus on inclusive credit assessment, borrowers can embark on a journey toward a stronger credit profile and financial stability.

Flexibility in Loan Tenure and Repayment Options:

Instant loan offers unparalleled flexibility in loan tenure and repayment options, catering to the diverse needs and preferences of borrowers. Unlike traditional lending institutions with rigid repayment terms, Digital Financing platforms empower borrowers to choose loan tenures that suit their financial circumstances.

Whether you need a short-term loan for a quick expense or a long-term loan for a major investment, digital lending has you covered. Additionally, borrowers can select from a variety of repayment options, including monthly installments, bi-weekly payments, or customized schedules. This flexibility allows borrowers to manage their cash flow effectively and repay loans on their terms. Embrace the freedom and convenience of digital lending, where flexible loan tenures and repayment options put you in control of your financial journey.

Data Privacy and Protection:

Data privacy and protection are paramount in the realm of digital lending. With the increasing reliance on online platforms, safeguarding sensitive information has become a top priority. Digital lending platforms employ robust data security measures to ensure the privacy and protection of borrower data.

Advanced encryption technology, secure data transmission protocols, and stringent access controls are in place to prevent unauthorized access or breaches. Additionally, digital lenders adhere to strict regulatory requirements and industry standards to maintain the highest levels of data privacy.

Borrowers can trust that their personal and financial information is safe and secure when opting for Digital Financing. With a strong focus on data privacy and protection, Instant loan platforms prioritize the trust and confidence of borrowers, making the borrowing experience seamless and secure.

Enhanced Credit Monitoring and Management:

Instant loan without documents online has revolutionized credit monitoring and management, providing borrowers with enhanced control and visibility over their credit. Through intuitive online platforms, borrowers can easily monitor their loan status, track payment history, and access account information in real-time.

This level of transparency empowers borrowers to stay informed and make informed decisions about their finances. Additionally, Digital Financing platforms often provide tools and resources to help borrowers manage their credit effectively. This includes features such as payment reminders, automated repayments, and financial planning tools.

With digital lending’s enhanced credit monitoring and management capabilities, borrowers can take charge of their financial journey, build stronger credit profiles, and achieve long-term financial success.

Increased Competition and Lower Interest Rates:

Digital lending has introduced increased competition in the lending landscape, leading to lower interest rates for borrowers. As digital lending platforms continue to gain popularity, traditional lenders are facing pressure to stay competitive.

This competition benefits borrowers by driving interest rates down, making loans more affordable. Digital lenders leverage technology and streamlined processes to reduce operational costs, allowing them to offer more competitive interest rates compared to traditional lenders.

With increased competition and lower interest rates, borrowers have more options and better opportunities to secure loans at favorable terms. Embrace the advantages of Digital Financing and take advantage of the increased competition in the market to access loans with lower interest rates, saving you money in the long run.

Support for Micro, Small and Medium Enterprises (SMEs):

Instant loan without documents online has become a vital source of support for micro, small, and medium enterprises (MSMEs). These businesses often face challenges in accessing traditional financing options due to their size or limited credit history.

However, Digital Financing platforms have emerged as game-changer, providing tailored loan products and simplified application processes specifically designed for MSMEs. By leveraging technology and data analytics, digital lenders can assess the creditworthiness of MSMEs accurately and provide quick approvals.

This access to timely and flexible financing empowers MSMEs to fuel their growth, expand operations, invest in new technologies, and meet working capital needs. With digital lending’s support, MSMEs can thrive, contribute to economic growth, and create employment opportunities. Embrace the power of Digital Financing to unlock the potential of your micro, small, or medium enterprise and propel it towards success.

Regulatory Framework and Consumer Protection:

Digital Financing operates within a robust regulatory framework, ensuring consumer protection and fostering a safe borrowing environment. Regulatory authorities have recognized the significance of digital lending and have established guidelines to safeguard the interests of borrowers.

These regulations encompass aspects such as interest rate caps, fair lending practices, transparent disclosure of terms and conditions, and dispute resolution mechanisms. Instant loan platforms comply with these regulations to maintain transparency, accountability, and consumer trust. By adhering to a strong regulatory framework, Instant loan promotes fair practices, protects consumer rights, and provides recourse for dispute resolution.

Borrowers can have confidence in the legitimacy and integrity of Digital Financing platforms, knowing that their interests are safeguarded by regulatory measures. Choose digital lending for a secure and protected borrowing experience, backed by a robust regulatory framework.

Improved Risk Assessment and Lower Default Rates:

Digital lending has revolutionized risk assessment in the lending industry, resulting in lower default rates. Through the use of advanced data analytics and machine learning algorithms, Digital Financing platforms can assess borrower creditworthiness more accurately than ever before.

This enhanced risk assessment allows lenders to make informed decisions, resulting in reduced default rates and minimized financial risks. By leveraging a vast amount of data and analyzing various factors, such as credit history, income, and repayment behavior, Instant loan platforms can identify borrowers who are more likely to meet their loan obligations.

This improved risk assessment not only benefits lenders but also provides borrowers with better loan terms and interest rates. Embrace Instant loan for improved risk assessment, lower default rates, and a more secure lending environment.

Empowerment of Women Entrepreneurs:

Instant loan has emerged as a powerful tool in the empowerment of women entrepreneurs. By providing easier access to capital, digital lending platforms are breaking down barriers and enabling women to pursue their entrepreneurial dreams.

Women entrepreneurs often face unique challenges in accessing traditional funding sources, but Digital Financing offers a level playing field. With streamlined processes, quick approvals, and flexible loan options, Instant loan empowers women to secure funds for business expansion, equipment purchase, marketing campaigns, or working capital needs.

Moreover, digital lending platforms consider alternative data sources and assess creditworthiness beyond traditional metrics, giving women entrepreneurs with limited credit history or collateral the opportunity to access funds. Embrace digital lending as a catalyst for women’s empowerment, where financial barriers are shattered, and entrepreneurial aspirations soar.

Instant loan without documents online available for Women Entrepreneurs

Data-Driven Decision Making:

Data-driven decision making lies at the core of digital lending, revolutionizing the way lending institutions operate. With access to vast amounts of data and advanced analytics, Instant loan platforms can make informed and precise decisions.

By leveraging borrower information, credit history, and financial data, lenders gain valuable insights into creditworthiness, risk assessment, and loan pricing. This data-driven approach not only enables faster loan approvals but also ensures fair and personalized loan terms for borrowers.

Instant loan platforms use data analytics to identify patterns, trends, and customer preferences, allowing them to offer tailored loan products and better serve their customers’ needs. Embrace the power of data-driven decision making in digital lending and experience a more efficient, accurate, and customer-centric lending process.

Types of loan available under instant loan without documents online

Digital lending offers a wide range of loan options to meet the diverse financial needs of borrowers. Whether you’re a small business owner, an individual seeking personal funds, or an entrepreneur looking to expand, Digital Financing has you covered.

Some common types of loans available under digital lending include personal loans, business loans, home improvement loans, education loans, vehicle loans, and debt consolidation loans. These loans can be customized to suit specific loan amounts, repayment terms, and interest rates.

With the convenience of digital platforms, borrowers can easily apply for loans online, get quick approvals, and receive funds directly into their bank accounts. Embrace the versatility of Instant loan and explore the various loan options available to fulfill your financial goals and aspirations.

Instant loan without documents online in Government Banks

Mudra Loan online without documents in Canara Bank, Bank of India, Union Bank of India,

Pre-Approved Personal Loan: This type of loan is available in the respective bank’s Mobile Banking App.

Instant loan without documents online for students Education Loan

Business Rule Engine

A business rule engine is a powerful tool in the world of Instant loan, streamlining decision-making processes and enhancing operational efficiency. By leveraging a set of predefined rules, a business rule engine automates complex business logic and decision-making in real-time.

In the context of Digital Financing, a business rule engine enables lenders to make quick and accurate assessments of loan applications, creditworthiness, and risk analysis. With the ability to analyze large volumes of data and apply specific rules, lenders can ensure consistent and fair loan evaluations.

This not only saves time but also reduces the risk of human error. By utilizing a business rule engine, digital lending platforms can provide borrowers with faster loan approvals, personalized loan offers, and improved customer experiences. Embrace the power of a business rule engine in digital lending and revolutionize your lending operations with speed, accuracy, and efficiency.

Documentation execution Digitally

Documentation execution digitally has transformed the lending landscape, making the loan process faster, more convenient, and secure. With digital lending, borrowers can now sign and execute loan documents electronically, eliminating the need for physical paperwork.

Through secure digital platforms, borrowers can review, sign, and submit documents from the comfort of their homes or offices. This digital documentation process not only saves time but also reduces the chances of document loss or errors. Digital signatures are legally binding and offer the same level of validity and authenticity as traditional ink signatures.

y embracing digital documentation execution, Instant loan ensures a seamless and hassle-free experience for borrowers, enabling them to access funds quickly and efficiently. Experience the convenience and efficiency of Digital Financing with streamlined documentation execution, and simplify your borrowing journey like never before.

Liveliness Verification

Liveliness verification is a cutting-edge technology that adds an extra layer of security and authenticity to the Instant loan process. With liveliness verification, borrowers can prove their identity and ensure that they are physically present during the loan application process.

This technology utilizes facial recognition and biometric authentication to detect and prevent fraudulent activities. By capturing real-time facial expressions, movements, or responses, liveliness verification confirms the borrower’s liveliness and prevents the use of manipulated or stolen identities.

This advanced verification method enhances the overall security of digital lending, instilling confidence in both lenders and borrowers. Embrace the power of liveliness verification in Digital Financing to experience a secure and trusted borrowing experience, free from identity theft and fraud.

Conclusion

Overall, digital loans in India have revolutionized the lending ecosystem, democratizing access to credit, improving efficiency, and empowering individuals with financial opportunities previously inaccessible to them.

The rise of digital loans in India has transformed the lending landscape, empowering individuals and businesses with accessible, convenient, and affordable financial solutions. As the digital infrastructure and fintech ecosystem continue to evolve, digital loans are expected to play an even more prominent role in driving financial inclusion and economic growth.

The rapid growth of digital loans in India has revolutionized the lending landscape, benefiting borrowers, promoting financial inclusion, and driving economic growth. As technology continues to advance, digital lending is expected to further evolve, offering innovative solutions and expanding financial opportunities for individuals and businesses across the country.