How to Improve cibil Score? Detailed Guide

Your CIBIL score is a crucial factor when it comes to obtaining credit from financial institutions. A high credit score indicates your creditworthiness and increases your chances of getting approved for loans or credit cards at favorable terms. On the other hand, a low CIBIL score can hamper your ability to secure credit. In this article, we will provide you with a comprehensive guide on how to improve cibil score and improve your financial prospects.

Table of Contents

1. Understand the Basics of CIBIL Score and Discover Effective Ways to Improve Your Creditworthiness:

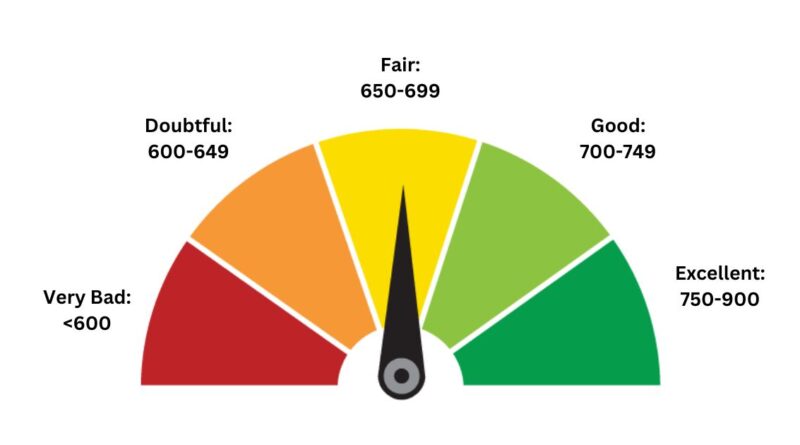

To understand how to improve cibil score, it is essential to have a clear understanding of how it works. The CIBIL score, ranging from 300 to 900, reflects your creditworthiness based on your credit history. A higher score indicates a lower risk for lenders, increasing your chances of getting approved for credit. By maintaining responsible credit habits, you can understand how to improve cibil score over time. It is crucial to regularly check your credit report from CIBIL or other credit bureaus to review your credit history and ensure its accuracy. This report will provide you with a comprehensive overview of your credit accounts, repayment patterns, and any discrepancies that need to be rectified which helps you in understanding how to improve cibil score.

2. Review Your Credit Report to understand how to improve cibil score:

Reviewing your credit report is a vital step in the process of how to improve cibil score. Obtain a free credit report from CIBIL or other credit bureaus in India and carefully analyze it for any errors or discrepancies. Look for incorrect personal information, outdated accounts, or unauthorized credit inquiries. If you identify any mistakes, report them to the credit bureau immediately to rectify the inaccuracies. These errors can have a negative impact on your credit score, so ensuring the accuracy of your credit report is crucial. By addressing and resolving any discrepancies, you can present an accurate picture of your creditworthiness to lenders, ultimately helping to understand how to improve cibil score. Regularly monitoring your credit report will also enable you to track your progress over time and identify areas for improvement.

3. Pay Your Bills on Time:

Paying your bills on time is one of the most critical factors influencing your CIBIL score. Late payments or defaults can significantly impact your creditworthiness. To understand how to improve cibil score, make it a priority to pay all your bills, including credit card bills, loan installments, and utility bills, on or before their due dates. Consider setting up reminders or automatic payments to avoid missing any payments. By consistently meeting your payment obligations, you demonstrate to lenders that you are a responsible borrower, increasing your chances of a higher CIBIL score.

4. Reduce Your Credit Utilization Ratio:

Your credit utilization ratio refers to the amount of credit you are currently using compared to the total credit available to you. It is recommended to keep your credit utilization ratio below 30%. For example, if your credit card limit is ₹1,00,000, aim to maintain a balance of ₹30,000 or lower. High credit utilization suggests a higher risk to lenders and can negatively impact your CIBIL score. To reduce your credit utilization ratio, you can consider paying off existing debts or increasing your credit limit. However, it’s important to note that increasing your credit limit does not mean you should spend more. The goal is to maintain a low balance relative to your available credit to demonstrate responsible credit management.

5. Avoid Multiple Loan Applications:

Each time you apply for a loan or credit card, it results in a hard inquiry on your credit report. Multiple hard inquiries within a short period can make you appear credit-hungry and may lower your CIBIL score. Instead of making numerous loan applications, conduct thorough research and compare loan offers before submitting an application. This way, you can ensure that you meet the eligibility criteria and have a higher chance of approval. Being selective with your applications can help maintain a positive credit profile and avoid unnecessary inquiries that could negatively impact your CIBIL score.

6. Maintain a Healthy Mix of Credit:

Having a healthy mix of different types of credit, such as loans and credit cards, can positively impact your CIBIL score. Lenders prefer borrowers who have successfully managed various credit types. However, it is important to be cautious and avoid taking on excessive credit just to improve your credit mix. Take on credit only when necessary and ensure that you can handle the repayment obligations responsibly. A diverse credit portfolio, when managed well, demonstrates your ability to handle different types of credit, thereby enhancing your creditworthiness and CIBIL score.

7. Keep Old Accounts Active:

The length of your credit history plays a role in determining your CIBIL score. It is beneficial to maintain older accounts that reflect a long history of responsible credit usage. If you have an old credit card with a good payment history, consider keeping it active and making occasional small purchases to keep the account open. This demonstrates a well-established credit history and adds positive weightage to your CIBIL score. However, be sure to monitor these accounts and ensure they do not incur any unnecessary fees or charges.

8. Settle or Manage Outstanding Debts:

If you have outstanding debts or defaults, it is crucial to address them promptly. Outstanding debts and defaults have a significant negative impact on your credit score. Consider paying off or settling the debts by working out a repayment plan with the creditors. Communicate and negotiate with them to find a solution that works for both parties. Taking proactive steps to manage and resolve your debts will not only improve your creditworthiness but also help in rebuilding your financial health.

9. Monitor Your Credit Regularly:

To track your progress and ensure that your efforts are paying off, it is important to monitor your credit score regularly. Check your CIBIL score periodically to stay updated on any changes or improvements. Several online platforms provide credit score tracking services that allow you to monitor your credit health effectively. By regularly reviewing your credit score, you can identify areas that need improvement and take appropriate measures to address them. Additionally, monitoring your credit also helps you detect any suspicious or fraudulent activities, allowing you to take prompt action to protect your creditworthiness.

10. Seek Professional Guidance:

If you find it challenging to navigate the process of improving your understanding how to improve cibil score on your own, consider seeking professional guidance. Credit counselors or financial advisors can offer personalized advice and strategies based on your specific financial situation. They can help you create a customized plan to improve your credit score and provide guidance on managing your finances effectively. Professional assistance can prove valuable, especially if you have complex financial situations or are facing significant credit challenges.

Improving your CIBIL score requires a thorough understanding of how credit scoring works and implementing responsible financial habits. By reviewing your credit report, paying your bills on time, managing your credit utilization ratio, avoiding unnecessary loan applications, maintaining a healthy credit mix, and resolving outstanding debts, you can steadily get the answer for how to improve cibil score. Remember to monitor your credit regularly, keep old accounts active, and seek professional guidance if needed. With time and dedication, you can enhance your creditworthiness, unlock better financial opportunities, and achieve your financial goals.

10 Benefits of Improved CIBIL Score

Improving your CIBIL score holds immense importance, as it has a direct impact on your financial well-being. A higher CIBIL score not only enhances your creditworthiness but also opens up numerous opportunities to secure better financial deals. In this article, we will explore the top 10 benefits of knowing how to improve cibil score specifically and how it can positively shape their financial future.

1. Access to Lower Interest Rates:

For Indian borrowers, a higher CIBIL score means access to loans at lower interest rates. Lenders in India offer preferential rates to individuals with good credit scores, resulting in substantial savings over loan tenure. By getting knowledge of how to improve cibil score, you can avail of loans at more affordable interest rates, reducing your overall borrowing costs.

2. Higher Loan Approval Chances:

In India, a strong CIBIL score significantly increases your chances of loan approval. Banks and financial institutions prioritize customers with good credit histories, making the loan approval process smoother and faster. By improving your CIBIL score, you enhance your eligibility and stand a better chance of securing the loan you need.

3. Improved Credit Card Offers:

A higher CIBIL score paves the way for better credit card offers and benefits. Banks in India offer premium credit cards with attractive features, such as higher credit limits, reward programs, discounts on dining, travel benefits, and exclusive access to events. By improving your CIBIL score, you gain access to these premium credit cards, allowing you to enjoy a wide range of privileges and perks.

4. Enhanced Negotiation Power:

With an improved CIBIL score, you gain stronger negotiation power when dealing with lenders in India. A good credit score positions you as a reliable borrower and gives you the ability to negotiate better terms, such as lower interest rates, reduced processing fees, or flexible repayment options. Lenders are more likely to accommodate your requests when they see a positive credit history.

5. Increased Home Loan Eligibility:

Planning to purchase a home, a higher CIBIL score is crucial. Lenders consider the CIBIL score as a key factor when assessing home loan applications. With an improved credit score, you increase your eligibility for higher loan amounts, favorable interest rates, and flexible repayment options. This allows you to fulfill your dream of owning a home more easily.

6. Enhanced Business Opportunities:

If you aspire to start a business in India, having a good CIBIL score is vital. A higher credit score opens doors to business loans, trade credit, and partnerships with favorable terms. Lenders and suppliers are more likely to trust you and extend credit or favorable business arrangements based on your creditworthiness. By improving your CIBIL score, you can create a strong foundation for your entrepreneurial endeavors.

7. Reduced Insurance Premiums:

In India, a good CIBIL score can lead to lower insurance premiums. Insurance companies often consider credit scores when calculating premiums for policies such as motor insurance, health insurance, or life insurance. With an improved CIBIL score, you can enjoy reduced insurance premiums, resulting in long-term savings.

8. Quick and Hassle-Free Loan Processing:

A higher CIBIL score expedites the loan processing time. Banks and financial institutions perform extensive credit checks during loan applications. A good credit score streamlines this process, reducing the time required for approval and documentation. With an improved CIBIL score, you can seize time-sensitive opportunities or address urgent financial needs promptly.

9. Better Rental Prospects:

In India, landlords and property management companies often check the CIBIL scores of potential tenants. A higher credit score increases your chances of securing desirable rental properties, as it reflects your financial stability and responsibility. By improving your CIBIL score, you become a more attractive tenant candidate, expanding your rental options.

10. Peace of Mind and Financial Stability:

Above all, improving your CIBIL score provides with peace of mind and financial stability. A higher credit score indicates responsible financial management, reducing the stress associated with credit-related challenges. With an improved CIBIL score, you gain better control over your financial health and open doors to a secure and prosperous future.

Improving your CIBIL score in India offers a multitude of benefits, ranging from access to better loan terms, improved credit card offers, and increased eligibility for home loans. It provides you with stronger negotiation power, opens up business opportunities, and leads to reduced insurance premiums. Additionally, a higher CIBIL score streamlines loan processing, enhances rental prospects, and ensures peace of mind and financial stability. By prioritizing the improvement of your CIBIL score, you can unlock these benefits and pave the way for a brighter financial future in India.

Loan Options for Individuals with a Low CIBIL Score:

If you find yourself in the “poor” or “fair” CIBIL score range, securing a loan from traditional banking institutions may be challenging. However, there are alternative options available:

Peer-to-Peer (P2P) Lending: P2P lending platforms connect borrowers directly with individual lenders willing to lend money. These platforms consider factors beyond just the CIBIL score, such as income, employment stability, and repayment capacity. Individuals with lower credit scores may find it easier to obtain loans through P2P lending, albeit at higher interest rates.

Secured Loans: In cases where traditional unsecured loans are unavailable, borrowers can explore secured loan options. These loans require collateral, such as property, gold, or fixed deposits, to secure the loan. The collateral provides assurance to the lender and increases the chances of loan approval, even with a low CIBIL score.

Credit Unions and Community Banks: Local credit unions and community banks often have more flexible lending criteria compared to larger financial institutions. They may consider personal relationships, employment stability, and overall financial health in addition to the CIBIL score when assessing loan applications.

Improve Credit Score: While exploring alternative loan options, it’s essential to work towards improving your credit score. Ensure timely payment of existing debts, maintain low credit utilization, and rectify any errors in your credit report. Gradually, as your score improves, you can qualify for better loan terms and options.

Conclusion: A low CIBIL score does not completely eliminate the possibility of obtaining a loan. While traditional banking institutions may pose challenges, alternative loan options such as P2P lending, secured loans, credit unions, and community banks provide avenues for individuals with lower credit scores. Simultaneously, focusing on improving your credit score is crucial for long-term financial health. Remember, responsible credit behavior and timely payments can gradually elevate your creditworthiness, opening doors to better loan opportunities in the future.