Difference between Equitable Mortgage and Registered Mortgage

It’s very important to know the difference between Equitable Mortgage and Registered Mortgage. When we decided to buy a property, most of us apply for a loan to make the payment to Purchase of property. When you take a loan bank mortgages your property. This simply means that they are in possession of our property until we repay the loan. If we fail to repay the loan, the bank may auction off the property to a third party.

Despite its slightly complicated definition, most of us have heard the word mortgage. However, few of you are aware of the Equitable mortgage or Registered mortgage terms. I have been working in the financial industry for long years and prepared lots of mortgage documents, after deep research and with my 10 years of experience in the financial industry and 5 years of experience in financial blogging I have written this article which definitely helps you to understand these mortgages.

Before understanding the main differences between the two mortgages. It is important to understand the Equitable Mortgage and Registered Mortgage.

Table of Contents

What is Equitable Mortgage?

Equitable Mortgage is a type of mortgage in which the borrower pledges real property as security for a loan, but the legal title to the property remains in the borrower’s name. Instead of holding a legal title, the lender holds an equitable interest in the property as security for the loan. If the borrower defaults on the loan, the lender may foreclose on the equitable interest and take ownership of the property. This type of mortgage is commonly used in India.

An equitable mortgage for a home loan is the most common type of mortgage. In this case, when you take money from the lender, the property documents remain with the lender. The term of a home loan is 20-30 years and the documents come back to you only after full repayment of the loan. During a reasonable mortgage, you transfer ownership of your property to your bank until you repay the full amount. If you default on a loan, allow them to take possession of your property.

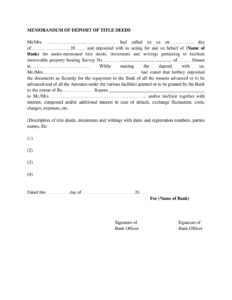

A memorandum of title deeds is prepared on behalf of the borrower. The memorandum is a record of all the documents submitted to the bank, stating that the borrower has voluntarily submitted all the home loan documents and paid the stamp duty. Depending on the state in which you live, charges range from 0.1% to 0.3% of the value of the home. It is also mandatory to record MOD (Memorandum of Deposit) with an organization called CERSAI (Central Registry of Securitization Asset Reconstruction and Security Interest).

What is Registered Mortgage?

A Registered Mortgage is a type of mortgage where the lender’s claim to the property is recorded in a land record. By registering the mortgage, the lender has a legally recognized and enforceable interest in the property, which serves as collateral for the loan. In case of default by the borrower, the lender may initiate foreclosure proceedings to take ownership of the property. This type of mortgage is commonly used in many countries, including India.

This type of mortgage requires the approval of the Sub-Registrar to finalize the agreement. Thus, the mortgagor and the mortgagor agree to adhere to a specific set of terms and conditions for the term of the loan set by the third party.

Simply put, in a registered mortgage, the borrower voluntarily gives full ownership of the property to the bank in case of default. In such a case, if you as a borrower default on the loan, the bank is allowed to dispose of the property as they wish. In this, in the format given by the bank, the mortgage has to be given to the bank from the Sub-registrar’s office.

What is the process of an equitable mortgage?

- Loan Sanction Letter: Read and understand Loan Sanction Letter and its Terms and Conditions, also confirm which type of mortgage the bank asked to do. This information is also available on the legal search opinion of panel advocates.

- Deposit of Title Deeds: For Equitable Mortgage you have to deposit the title deed or sale deed of your property in the bank.

- The borrower has to sign on the Equitable Mortgage register maintained at the branch, in this register all the details of property and details of deposited title deeds are mentioned.

- Memorandum of Deposit Title deeds: Bank officials give you a “Memorandum of Deposit of title deed” with two official signatures on it, you have to attach the required stamp paper as per instruction of the bank.

- You have to take this Xerox copy of the “Memorandum of Deposit of title deed with stamp paper” to the Sub Registrar’s office.

- At the Sub Registrar’s office, you have to file a “Notice of intimation” which means you are informing the Sub Registrar’s office of your “Deposit of title deeds” at the Bank, then you will get a Receipt and Index 2 document as a proof of “Notice of intimation” which you need to submit to the bank.

- Encumbrance-free Declaration: at the time of any mortgage you have to submit an “Encumbrance-free Declaration” stating that no case is pending in front of a court or no other charges on it.

- If you purchase a flat from a builder then you have to take the “Encumbrance free Declaration” and No Objection Certificate from the Builder to create a charge.

- Finally, after completing the equitable mortgage procedure you have to give an affidavit to the bank stating that “you have no any pending dues of Income Tax or any other Tax authorities.

What is the process of a Registered mortgage?

- Read and understand Loan Sanction Letter and its Terms & Conditions and also confirm which type of mortgage the bank is asked to do. This information is also available on the legal search opinion of the panel advocate.

- Bank will provide a sample format for the Registered Mortgage document, print it out, and cross-check and sign it by a bank official.

- Attach the required amount of stamp paper and submits it to the Sub Registrar’s office there may be Registration charges in addition to Stamp Duty in some states.

- Sub Registrar’s office will register your Register Mortgage in their records and return it after signing with the official seal.

- Submit this to the bank and the bank will keep it with your loan documents.

- Encumbrance-free Declaration: at the time of any mortgage you have to submit an “Encumbrance-free Declaration” stating that no case is pending in front of a court or no other charges on it.

- Submit one Xerox copy to the City Survey Office of your area for charge noting on your property card.

Now that we know the main differences between the two terms, let us understand what will work for you based on the specific key parameters.

What is the difference between Equitable Mortgage and Registered Mortgage?

| Parameters | Equitable Mortgage | Registered Mortgage |

| Registration | Earlier equitable mortgage is not required to register but currently, it is registered by way of the “Notice of Intimation” process | A registered mortgage is executed and registered in Sub Registrar’s office |

| Where to do the process? | Deposit of Title deed at Branch and “Notice of intimation” at Sub Registrar office | at Sub Registrar’s office |

| Charges | Stamp duty 0.3% and “Notice of Intimation” charges Rs. 1000/- | Stamp duty is 0.3% and Registration charges 1.5% |

| Original title deeds | You have to deposit original title deeds such as Sale Deeds in the bank | A registered mortgage has been done where the sale deed is not available |

| Bank Preference | Where Sale deeds are available banks prefer Equitable Mortgage | A registered mortgage is preferred in Banks where Sale Deeds are not available |

| Mode | Online or Offline | Offline only |

Is it necessary to register an equitable mortgage?

Earlier it is not required to register an equitable mortgage but currently, an equitable mortgage is also required to register at the Sub Registrar’s office by way of a “Notice of intimation”. Even after doing this, you have to submit a copy of Index 2 to the City Survey office to create a charge on your property.

What banks prefer equitable or registered mortgages?

Instead of having an ample amount of benefits to both parties in the equitable mortgage, banks prefer mainly registered mortgages because earlier in an equitable mortgage there are no records of the loan or the property in the sub registrar’s office. This leaves the possibility of the property being sold to a third party without fully repaying the loan. Hence, banks and many financial institutions consider registered over equitable. Many fraud cases have also been registered related to an equitable mortgage.

Similarities between the Equitable mortgage and Registered Mortgage: The similarities between the Equitable mortgage and Registered Mortgage are that in both cases the bank takes your original documents and returns them only when you repay the loan. In both cases, the lender has the right to sue for non-payment

SARFAESI act in relation to Equitable and Registered mortgage?

The Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act is an Indian legislation passed in 2002. The act provides a framework for the securitization and reconstruction of financial assets and the enforcement of security interests by banks and financial institutions.

In relation to Equitable and Registered Mortgage, the SARFAESI Act enforces security interest in the case of default by a borrower. If a borrower fails to repay a loan, the bank can take possession of the property that was used as collateral and sell it to recover the loan amount.

Earlier under the SARFAESI Act, a registered mortgage holds a higher priority over an equitable mortgage in case of a default. A registered mortgage is created by executing a mortgage deed and registering it with the Sub Registrar’s office. But currently, an equitable mortgage is created by depositing the title deeds with the bank and registering it with Sub Registrar by way of a “Notice of Intimation”.

In conclusion, the SARFAESI Act provides a comprehensive framework for the securitization and reconstruction of financial assets and the enforcement of security interests by banks and financial institutions.

What happens if you don’t pay?

In any case, if you don’t repay your loan as per the terms of your sanction, then definitely the bank will take possession of your property and auction your property to recover the loan amount, so never think about “What happens if you don’t pay”.

Equitable Mortgage Format (Wording)

Registered mortgage format (Wording)

Frequently Asked Questions

Q1: Why is an equitable mortgage more popular than a registered mortgage in some states?

Answer: Earlier, the stamp duty for equitable mortgage is less than that of registered mortgage but currently stamp duty for both mortgage is the same. Still charges for “Notice of Intimation” are less than registration charges in Registered mortgage.

Q2: Does an equitable mortgage need to be registered?

Answer: Yes, Equitable Mortgage needs to be registered with the Sub Registrar office; it is called “Notice of Intimation”

Q3: Can equitable mortgage be created without a title deed?

Answer: No, Equitable Mortgage can be created only when Sale Deed is available; it consists of a “Deposit of Title Deed” in the branch.

Q4: What documents are required for registered mortgage?

Answer: Sanction letter, Latest property card or 7/12, KYC documents etc.

Q5: What are the documents required for equitable mortgage?

Answer: Sanction letter, sale deed, land records, etc, and any other documents mentioned in the Legal Search report.