Difference between NEFT, RTGS, IMPS and UPI

In the digital era, where convenience and speed are paramount, electronic fund transfers have become an integral part of our financial lives. Three popular methods for transferring funds in India are NEFT, RTGS, and IMPS. These services offered by banks provide efficient and secure ways to move money between accounts. However, understanding the differences between these systems is crucial to ensure you choose the right option for your specific needs. In this article, we will explore the contrasts between NEFT, RTGS, and IMPS, shedding light on their unique features and benefits.

The three different methods by which money can be transferred online are mentioned below:

- National Electronic Funds Transfer (NEFT)

- Real-Time Gross Settlement (RTGS).

- Immediate Payment Service (IMPS)

- Unified Payment Interface (UPI)

Table of Contents

NEFT (National Electronic Funds Transfer)

National Electronic Funds Transfer, commonly known as NEFT, is a popular electronic payment system in India. It allows individuals and businesses to transfer funds from one bank account to another across different banks. NEFT operates on a deferred settlement basis, meaning that transactions are processed in batches rather than instantly.

Key Features of NEFT:

1. Settlement Time: NEFT operates in hourly batches from 8:00 am to 7:00 pm on weekdays and from 8:00 am to 1:00 pm on Saturdays, excluding bank holidays. The funds are generally credited to the recipient’s account on the same day or the next working day, depending on the batch timing.

2. Transaction Limits: NEFT does not have a minimum transaction limit, making it suitable for small-value transfers. However, there is a maximum transaction limit of ₹10 lakh per day, which may vary based on the bank’s policies.

3. Availability: NEFT is available for both online and offline transactions. Many banks offer NEFT services through Internet banking, mobile banking apps, and branches.

RTGS (Real-Time Gross Settlement):

Real-Time Gross Settlement, or RTGS, is a payment system that enables real-time transfer of large-value funds. Unlike NEFT, RTGS processes transactions individually, ensuring instant and secure transfers. This system is primarily designed for high-value transactions.

Key Features of RTGS:

1. Settlement Time: RTGS transactions are processed instantly and on a real-time basis. However, it is important to note that RTGS operates during specific working hours, typically from 8:00 am to 6:00 pm on weekdays and from 8:00 am to 1:00 pm on Saturdays, excluding bank holidays.

2. Transaction Limits: RTGS is suitable for transferring large amounts of money. The minimum transaction limit for RTGS varies from bank to bank, but it is usually set at ₹2 lakh. There is no maximum transaction limit.

3. Availability: RTGS can be accessed through Internet banking, mobile banking apps, and by visiting the bank’s branch.

IMPS (Immediate Payment Service):

Immediate Payment Service, commonly known as IMPS, is a fast and real-time interbank electronic funds transfer system in India. IMPS allows users to send and receive money instantly using their mobile phones or Internet banking.

Key Features of IMPS:

1. Settlement Time: IMPS transactions are processed instantly, 24/7, including weekends and holidays. This makes it the fastest mode of transferring funds among NEFT, RTGS, and IMPS.

2. Transaction Limits: IMPS offers flexibility in transaction limits, ranging from a minimum of ₹1 to a maximum of ₹2 lakh, depending on the bank and type of account. Some banks even allow higher limits through IMPS for specific types of transactions.

3. Availability: IMPS can be accessed through mobile banking apps, internet banking, and ATM services offered by banks.

NEFT RTGS IMPS Difference, Timing, Charges, Limit

| Category | NEFT | RTGS | IMPS |

| Minimum Amount | Rs.1 | Rs. 2,00,000/- | Rs.1 |

| Maximum Amount | No limit from a branch, Limited by net banking | No upper limit | Rs. 2,00,000/- |

| Type of settlement | Batches | Real-Time | Real-Time |

| Speed of settlement | Officially 48 hours (usually 2- hours) | Immediately | Immediately |

| Availability | As per RBI Batch Timing | As per RBI Batch Timing | 24/7 |

| Mode | Online/Offline | Online/Offline | Online |

Remember these things before you transfer money.

Timings: NEFT and RTGS transactions are done in batches and batch timing is decided by RBI. You have to initiate your transaction at least before the last batch of the day. IMPS and UPI payments are available 24×7.

NEFT RTGS IMPS Difference in transaction Fee:

| Charges Slab | NEFT Charges | RTGS Charges | IMPS |

| Up to Rs.10,000 | Rs. 2.25 + Applicable GST | Not Applicable | Depends on Bank |

| Above Rs. 10,000 and up to Rs. 1 lakh | Rs. 4.75 + Applicable GST | Not Applicable | Depends on Bank |

| Above Rs. 1 lakh and up to Rs. 2 lakh | Rs. 14.75 + Applicable GST | Not Applicable | Depends on Bank |

| Above Rs. 2 lakh and up to Rs. 5 lakh (Incl. Rs. 2 lakh for RTGS) | Rs. 24.75 + Applicable GST | Rs. 20 + Applicable GST | Not Applicable |

| Above Rs. 5 lakh and up to Rs. 10 lakh | Rs. 24.75 + Applicable GST | Rs. 45 + Applicable GST | Not Applicable |

Understanding the differences between NEFT, RTGS, and IMPS is essential for choosing the right method for your fund transfer needs. While NEFT is suitable for small-value transactions processed in batches, RTGS ensures instant and secure transfers for high-value transactions during specific working hours. On the other hand, IMPS offers real-time transfers 24/7, making it ideal for immediate fund transfers using mobile phones or Internet banking. By evaluating your transaction requirements, you can select the most appropriate option that aligns with your specific needs and preferences.

Exploring the Power of UPI: Explained in Detail

In recent years, Unified Payments Interface (UPI) has emerged as a game-changer in the Indian financial landscape. With its seamless and instant payment capabilities, UPI has revolutionized the way we transfer money, make payments, and conduct transactions. In this comprehensive guide, we delve into the world of UPI, understanding its features, benefits, and how it has transformed digital payments in India.

What is UPI?

Unified Payments Interface (UPI) is a real-time payment system developed by the National Payments Corporation of India (NPCI). It allows individuals and businesses to link multiple bank accounts to a single mobile application, providing a simple and secure way to make money transfers and payments.

Key Features and Benefits of UPI:

Instant Transfers: UPI enables real-time fund transfers between bank accounts. Whether you’re sending money to a friend, paying bills, or making online purchases, UPI ensures instant settlement, eliminating the need for traditional payment methods like cash or cheques.

Single Platform for Multiple Accounts: One of UPI’s key advantages is its ability to link multiple bank accounts to a single UPI-enabled application. This eliminates the need to switch between different banking apps or carry multiple cards, making transactions more convenient and efficient.

Easy Authentication: UPI transactions are authenticated through a unique UPI ID or Virtual Payment Address (VPA), which is created during the registration process. This eliminates the need to remember complex bank account details or share sensitive information during transactions, enhancing security.

Secure and Encrypted: UPI employs advanced encryption technology to ensure the security of transactions. Additionally, UPI uses two-factor authentication (2FA) methods such as PIN, fingerprint, or iris scan, adding an extra layer of protection against unauthorized access.

Utility Bill Payments: UPI has expanded beyond person-to-person transactions. It now allows users to pay utility bills, such as electricity, water, and gas, directly through the UPI-enabled app. This feature streamlines bill payments, saving time and effort.

Seamless Merchant Payments: UPI has gained significant traction among merchants, enabling them to accept payments from customers through UPI-enabled apps. It offers a quick and convenient checkout process, fostering a cashless economy and reducing the dependency on physical currency.

How to Use UPI:

Choose a UPI-enabled App: To use UPI, you need to download a UPI-enabled app from your bank or a third-party app provided by a payment service provider. Popular UPI-enabled apps include Google Pay, PhonePe, Paytm, and BHIM (Bharat Interface for Money).

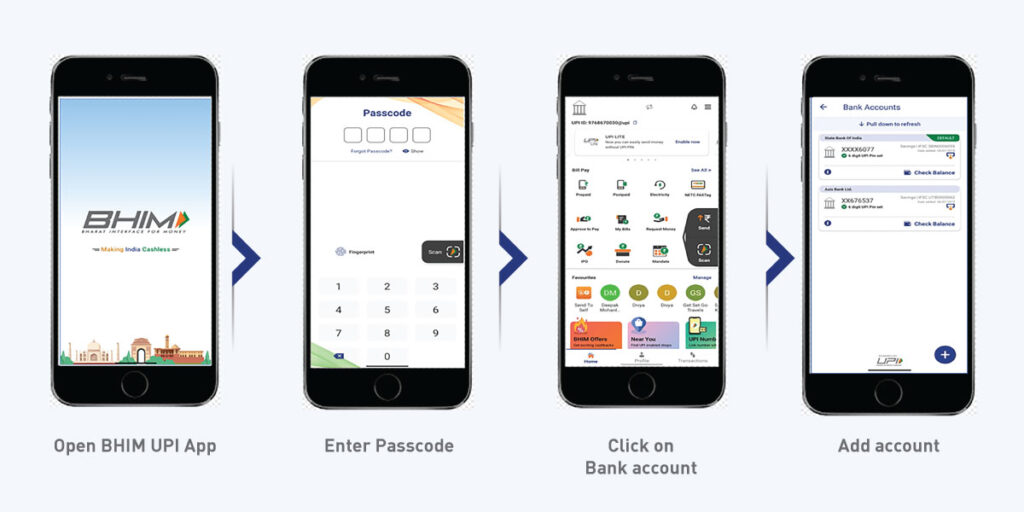

Registration: Once you have the app, you need to complete the registration process. This typically involves verifying your mobile number linked to the bank account, creating a UPI ID (VPA), and setting a UPI PIN for secure transactions.

Link Bank Accounts: After registration, you can link multiple bank accounts to the UPI-enabled app by providing the necessary details and completing the verification process. This allows you to access and manage all your accounts from a single app.

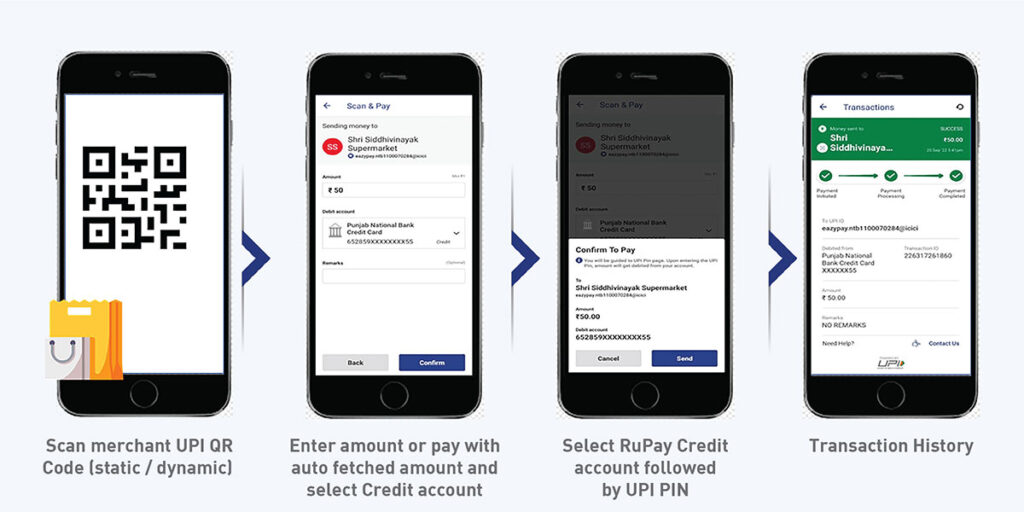

Make Transactions: With your UPI app ready, you can initiate transactions by entering the recipient’s UPI ID or scanning a QR code. Specify the amount and authorize the transaction using your UPI PIN. The funds will be instantly transferred from your bank account to the recipient’s account.

Conclusion: UPI has revolutionized the way we make payments and conduct financial transactions in India. Its instant, secure, and convenient features have made it the go-to choice for individuals and businesses alike. Whether you want to transfer money, pay bills, or make purchases, UPI offers a unified platform that simplifies the entire process. By embracing UPI, you can join the digital payment revolution and experience the seamless world of instant transactions at your fingertips.

Steps to Link your RuPay credit card to any UPI app

Steps to make payment using RuPay credit card to any UPI app

Frequently Asked Questions

Q1. Which is the faster payment mode between NEFT or RTGS?

Ans: The speed of payment depends on how much money you transfer. The above amount of Rs two lakh goes through RTGS which is credited earlier than NEFT.

Q2. Can RTGS be canceled once done?

Ans: No. Once done RTGS cannot be canceled so the information should be filled in carefully while transferring the payment.

Q3. What information needs to be filled in while doing RTGS or NEFT?

Ans: In order to send RTGS, the customer has to provide the following information to the bank: i. Remittance amount, ii. Account number to be debited, iii. Name of Beneficiary Bank and Branch, iv. IFSC number of the branch received, v. Beneficiary Customer Name, vi. Beneficiary customer’s account number, vii. Sender of recipient information if any

Q4. Does the system send the amount by confirming the name if the account number is wrong while sending the amount through RTGS?

Ans: Transactions in RTGS take place in real-time and their number is very large so it is not possible to match the name and account number before giving credit to the beneficiary. The amount is sent only after confirming the account number of the beneficiary.

Q5. How do we know that the amount has been credited after remittance through RTGS?

Ans: The remittance bank will receive a message from RBI that the amount has been credited to the beneficiary bank/customer account. Based on this, the sending bank should inform the sending customer that the money has been credited to the beneficiary’s bank account.

Q6. If the money is not credited to the beneficiary’s account, how long will it take to get it back?

Ans: If for any reason it is not possible to deposit money in the beneficiary’s account, the RTGS member returns the money received from the bank to the original bank within one hour of receipt of payment on the payment interface.

Q7. What is a UTR number?

Ans: Unique Transaction Reference (UTR) number is the 22 alphanumeric code used to specify the transaction in the RTGS system.

Pingback: Hidden Bank Charges – How to Identify & Avoid Them